Import Duties for Vietnam

If you want to know what the import duty for your garment is then you need to know your HS Code. (I will explain HS Codes below.) My assumption is that you are importing from Vietnam into USA. Duty rates are different for every country. With your HS Code in mind, then you can look up your US import duty rates. For example a t-shirt has a duty rate of 16.5% (cotton) and 32% (polyester). Where do you look it up? You look it up in the Harmonized Tariff Schedule which I will explain shortly.

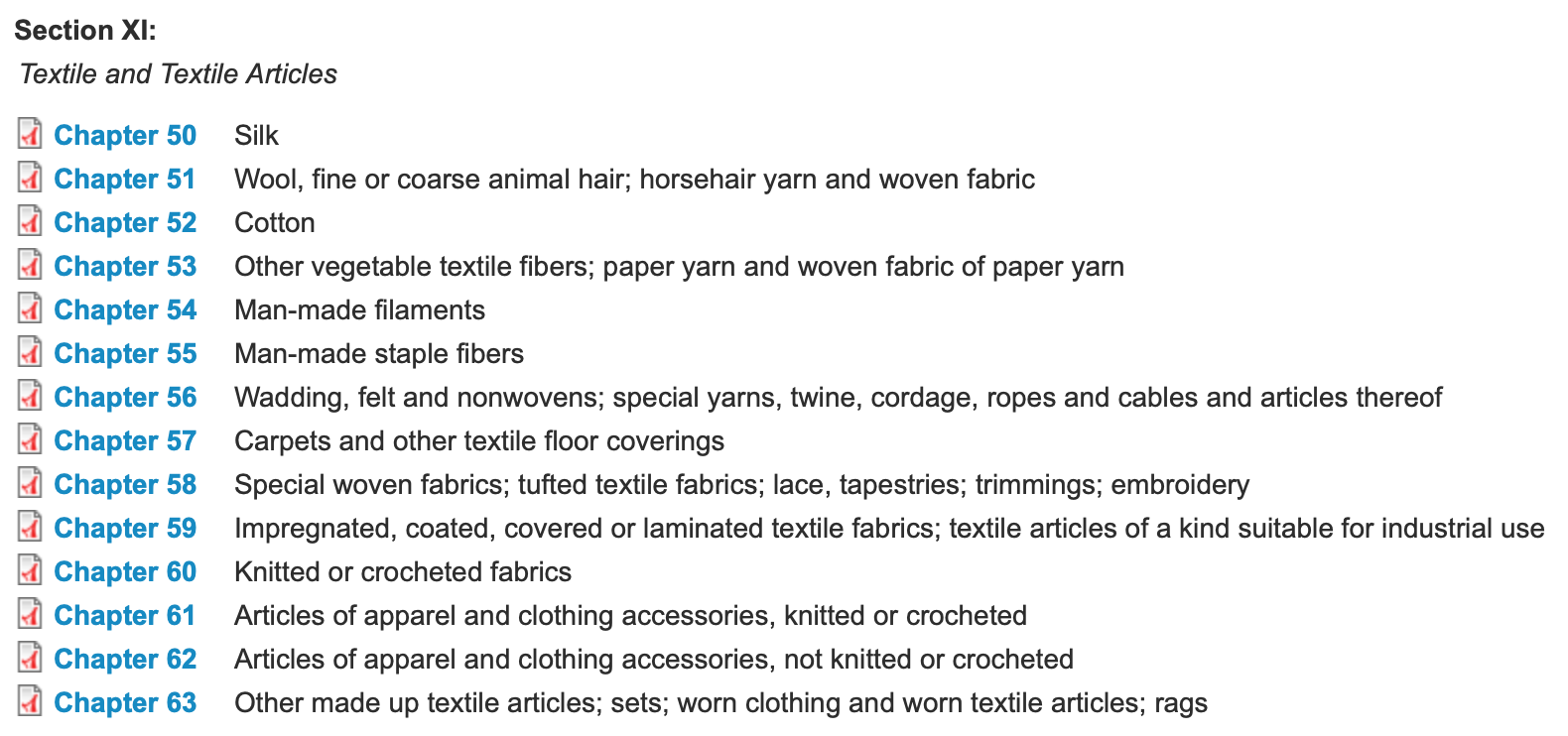

The HS Code system was created by the World Customs Organization (WCO) to categorize ALL “manufactured things” into approximately 5,000 commodity groups. This system is accepted and implemented by more than 200 countries worldwide. For example if you are producing t-shirts made with polyester yarn then the HS Code is 6109.90.10.

The Harmonized Tariff Schedule is a list of these HS Codes with their corresponding duty rate specifically for the US. In fact every country has their own unique Harmonized Tariff Schedule because import duty rates vary from country to country. For example you can google Australian Harmonized tariff schedule. Be aware that some countries call it something different like the Australian Harmonized Export Commodity Classification (AHECC).

Here is the link to the US Harmonized Tariff Schedule. Open it and find the link for chapter 61. Open chapter 61 pdf. Then search for 6109.90.10. If you need additional help then contact me. I offer consulting to get you answers.

Website Sitemap

- How to Start a Clothing Line Producing Overseas How to start a clothing line producing overseas? Chris' expertise is advising fashion start-ups on how to start a clothing line producing in overseas.

- How to Start a Clothing Company Manufacturing in Vietnam Chris Walker knows how to start a clothing company manufacturing in Vietnam. Start with getting price quotes and samples made.

- Apparel Design and Development Services in Vietnam Are you looking for apparel design and development services in Vietnam? Chris can help design and develop your apparel ideas.

- Garment Production Services in Vietnam Do you need garment production services in Vietnam? Chris provides garment production services in Vietnam.

- How to Start a Clothing Business in Asia How to start a clothing business in Asia? Chris' books are gold mines of information to start a clothing business maufacturing in Asia.

- Apparel Tech Pack Templates Free Download Chris and Meg offer apparel tech pack templates free downloads as well as ebooks for fashion start ups.

- How to Produce a Clothing Line in Vietnam How to produce a clothing line in Vietnam? Chris can help you produce your clothing line in Vietnam.

- Fashion Start Up Internship in Vietnam Would you like to apply for a fashion start up internship in Vietnam? We design a collection and create the marketing and sales plan.

- Apparel Business Planning Internship in Vietnam Would you like to apply for an apparel business planning internship in Vietnam? We use Live Plan to write your pitch, do market research and calculate financials.

- Video Production Internship in Vietnam Would you like to apply for a video production internship in Vietnam? We use Screenflow and Pixelmator to produce short information videos.

- Digital Marketing Internship in Vietnam Would you like to apply for a digital marketing internship in Vietnam? We use Google Analytics and Google Tag Manager to track web traffic.

- Fashion Start-Up Consultant in Vietnam Chris is a fashion start-up consultant in Vietnam that can help you launch your clothing line producing in Vietnam.

- How to Write a Fashion Startup Business Plan in Vietnam Learn how to write a fashion startup business plan in Vietnam. I recommend using Live Plan online application and include your Why

- Fashion Startup Business Plan Template Five statements need to be in your fashion startup business plan template. Know your why, how, what mission and vision.

- How to Write an Apparel Business Plan How to write an apparel business plan starts with having a strong marketing and sales plan from day one.

- How to Write a Garment Business Plan I explain how to write a garment business plan by predicting your expenses and figuring out how much money you need to borrow.

- How to start a fashion business with low MOQ in Vietnam Chris Walker knows how to start a fashion business with low MOQ in Vietnam. First step is to contact factories.

- Small batch clothing manufacturing in Vietnam Chris Walker can help you with small batch clothing manufacturing in Vietnam. First step is to get your tech packs made.

- Apparel Tech Packs Blog Hire apparel tech pack services in Vietnam or learn how to make your tech packs before producing in Vietnam.

- Make Your Garment Tech Packs in Vietnam

- What garment measurements go into an apparel tech pack?

- Should I include a sample request in my apparel tech pack?

- What folding instructions need to be in a apparel tech pack?

- What packing instructions need to be in an apparel tech pack?

- How to describe hang tags in apparel tech packs?

- Do I need care labels and branding labels in my apparel tech pack?

- What is the best format for artwork in an apparel tech pack?

- How to describe color in an apparel tech pack?

- What construction details need to be in an apparel tech pack?

- What is the best way to do call outs in an apparel tech pack?

- What is the difference between technical sketches and fashion illustration?

- Should the bill of materials in a tech pack include price?

- What is the best garment tech pack cover sheet design?

- How much does an apparel tech pack cost in Vietnam?

- If I pay, will the sewing factory give me the tech pack for my garment?

- Apparel Tech Pack Freelance Directory Apparel tech pack freelance directory for fashion start ups to contact and prepare for production in Vietnam

- Apparel Tech Pack Freelancer in New York Nadia Tandra is an apparel tech pack freelancer in New York that can make your tech packs and prepare you for production in Vietnam.

- Apparel Tech Pack Freelancer in Vietnam Dane Nguyen is an apparel tech pack freelancer in Vietnam that can make your tech packs and prepare you for production in Vietnam.

- Apparel Tech Pack Services in Berlin Diep is from Vietnam and lives in Germany. She offers apparel tech pack services in Berlin. Her specialty is technical design of activewear.

- Womenswear Fashion Designer in San Francisco Carla is a womenswear fashion designer in San Francisco that offers tech pack services using Photoshop, Illustrator and In Design.

- Technical Apparel Design Services in Los Angeles Belinda offers technical apparel design services in Los Angeles. She can do tech packs, garment design and offer merchandising advice.

- Garment Tech Pack Freelancer in Perth Sunitha is a garment tech pack freelancer in Perth that has 20 years experience with pattern making and cutting for ladies fashion.

- Apparel Tech Pack Freelancer in Manchester Sarah Cordery is an apparel tech pack freelancer in Manchester. She offers garment design and illustration services.

- Freelance Lingerie Designer and Corset Maker in Sheffield Lou Watson is a freelance lingerie designer and corset maker in Sheffield, South Yorkshire, United Kingdom and she can do tech packs.

- Freelance Apparel Designer in Phoenix Paige is a freelance apparel designer in Phoenix that specializes in kids and womenswear.

- Freelance Apparel Designer in Los Angeles Toni is a freelance apparel designer in Los Angeles, California, that specializes in women's denim.

- Freelance Tech Pack Designer in Ho Chi Minh City Ann is a freelance tech pack designer in Ho Chi Minh City, Vietnam, that specializes in women's contemporary clothing.

- Freelance Tech Pack Designer in Ward Colorado Natalie Waltrip is a freelance tech pack designer in Ward, Colorado, specializing in articulated fit for athletic apparel.

- Lingerie Apparel Designer in Johore Malaysia Divya is an apparel designer in Johore, Malaysia that specializes in lingerie design.

- Garment Sample Room in Vietnam Work with a garment sample room in Vietnam that speaks english well and can do small quantity.

- What is the import duty for Vietnam? What is the import duty for Vietnam?